Small Credit Union HR Solutions

Competitive plans helping small credit unions deliver

high-quality benefits at lower costs.

I-Care Agency

A CUSO insurance agency built exclusively for small credit unions. Big insurance companies struggle to scale down and deliver competitive plans for small credit unions, while small insurance brokers often deliver un-tailored and high-cost products. To change the course of our employee benefits and medical insurance spending, we need to do something different and better. Our CUSO's innovative and collaborative solutions offer small credit unions the following options: |

|

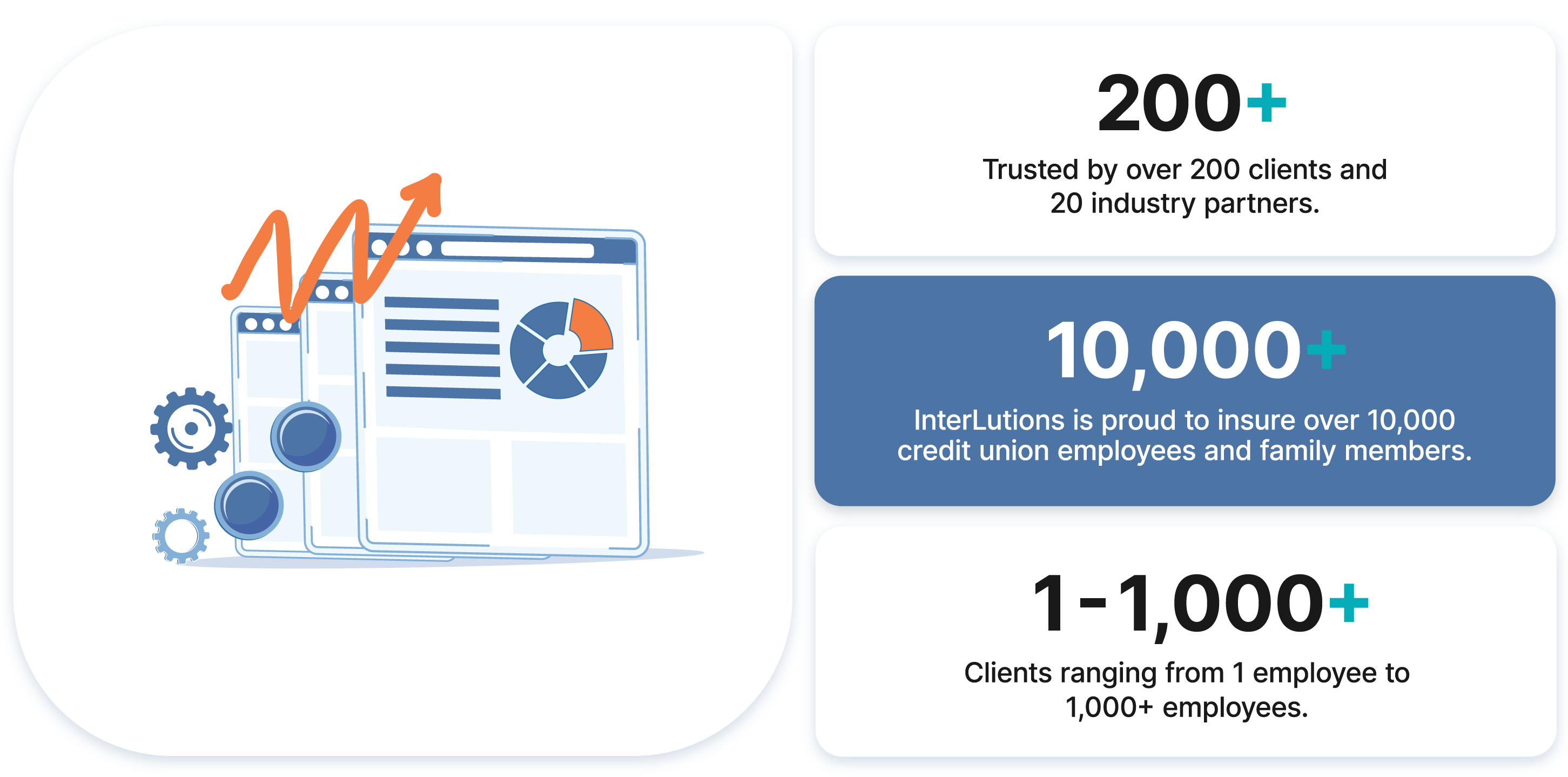

What Sets Us Apart?

- Benefit Administration: Digitize open enrollment, manage employee data, and simplify plan designs with our intuitive platform.

- HSA, FSA, and COBRA Management: Offer tax-advantaged savings and ensure compliance with federal regulations.

- Certified HR and Compliance Support: Stay ahead of ACA, ERISA, and HIPAA requirements with expert guidance and automated tools.

- Wellness Programs: Promote healthier lifestyles and reduce claims with customizable wellness initiatives.

Frequently Asked Questions

Yes! I-Care offers competitive health plans to credit unions between 1 employee and 1,000 employees. Our CUSO’s I-Care Agency was built to deliver plans exclusively for small credit unions.

Every credit union client of our CUSO has access to a dedicated service consultant, a SHRM certified compliance manager, a wellness certified advisor, and a licensed agent with access to several unique insurance markets.

Yes. Every credit union is set up on our employee benefit administration portal to help streamline the benefit management process, digitize the open enrollment process, and enhance the overall security of your plan offerings. Initial and ongoing training is offered for free to all of our clients.

Our CUSO has access to exclusive and collaborative health plans for credit unions. We leverage claims data and expanded underwriting strategies to negotiate lower rates, and we leverage our size and industry expertise to work with multiple insurance carriers across the country.

Simply contact us for a free consultation. We will assess your needs, provide consultative advice, and deliver customized quotes unavailable through any other insurance broker.

Need More Information?

Discover how InterLutions can empower your credit union.

Why Credit Unions Choose I-Care

UP Federal Credit Union

“They worked hard to find us affordable premiums and good coverage.”

Karyn Davis

President/CEO

Oakdale Credit Union

“We love how easy I-Care was to setup and track our employees’ insurance options.”

Colleen Woggon

CEO

Marshfield Medical Center Credit Union

“We saw a decrease in premiums and the benefits improved tremendously.”

David Murphy

President/CEO

Iron County Community Credit Union

“Working with InterLutions was one of the best decisions I made!”

Mark Marczak

President/CEO

Co-op Credit Union

“The partnership with their team is exceptional.”

Michele Steien

Chief Talent Officer

N.E.W. Credit Union

“The I-Care team has been great to work with.”

Lisa Gilligan

President/CEO

Resources

Wellness: Your Secret to Savings

According to the Centers for Disease Control and Prevention (CDC), chronic diseases account for 90% of healthcare costs, morbidity, and mortality. Today, more than ever, we need new tools to identify and address the underlying risks and health issues, specifically ways to increase health literacy and personalized care plans to reverse the chronic disease epidemic.

Understanding Your Health Plan

Health insurance carriers design health plans to transfer some of the risk (costs) to you through four insurance concepts: deductibles, co-insurances, co-pays, and out-of-pocket-maximums, yet most of us with insurance don’t really know what we have.

Debunking health plan renewal myths: You don’t have to wait to find better benefits

Take a look at three common myths in the health insurance industry, and what we can do differently to help our employees and our bottom lines.

Help Your Employees Distinguish Between FSAs, HRAs, and HSAs

Although human resources professionals are very familiar with these accounts, some employees may not understand how to distinguish between flexible spending accounts, health reimbursement arrangements, and health savings accounts.

Insurance Captives: Are They Right for Your Credit Union?

Captives work for some employers but not for others. How can you be certain that you are making the right decision for your organization?

Leveraging Collaboration, Data, and Enhanced Underwriting to Drive Down Healthcare Costs

How can credit unions continue delivering robust and competitive employee benefits when the trajectory of healthcare costs is rising at such a steep pace? Here are three tips to help get us in the right direction.

The C-Suite’s Guide to Enhancing Employee Benefits and Reducing Costs

A collaborative healthcare model is the best strategy for credit unions to combat rising medical insurance and employee benefit costs as insurance carriers continue profiting from a broken system.

Why Association Health Plans Work for Credit Unions

Just as in the very collaborative spirit of the credit union movement itself, AHPs benefit from the strength and unity of their many combined employees.

Industry Partners

More Solutions

Business Member Benefits

Build new revenue streams and deliver value-add solutions to your business accounts.

Collaborative Health Plans

From captives to association plans, we offer several pooled health plans to meet your needs.

WE-Care: Employee Wellness

Leverage claims data and wellness consultants to improve the health of your employees.